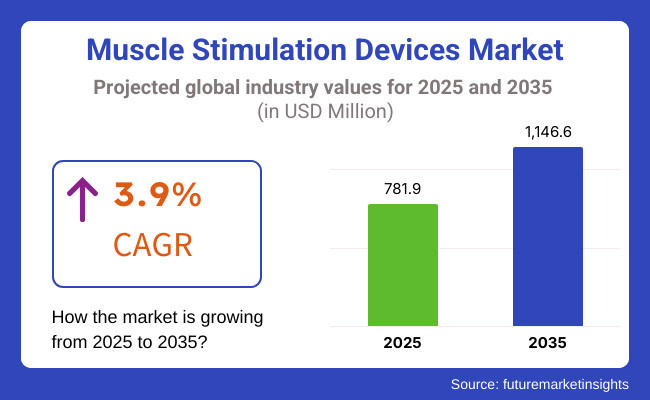

The electrotherapy device market is experiencing robust growth, driven by rising demand for non-invasive pain management and rehabilitation solutions. Leading manufacturers combine cutting-edge technology with clinical efficacy to serve diverse healthcare settings. Here, we profile the industry’s top 10 innovators, with a focus on their technological edge and global impact.

top 10 Electrotherapy Device Manufacturers

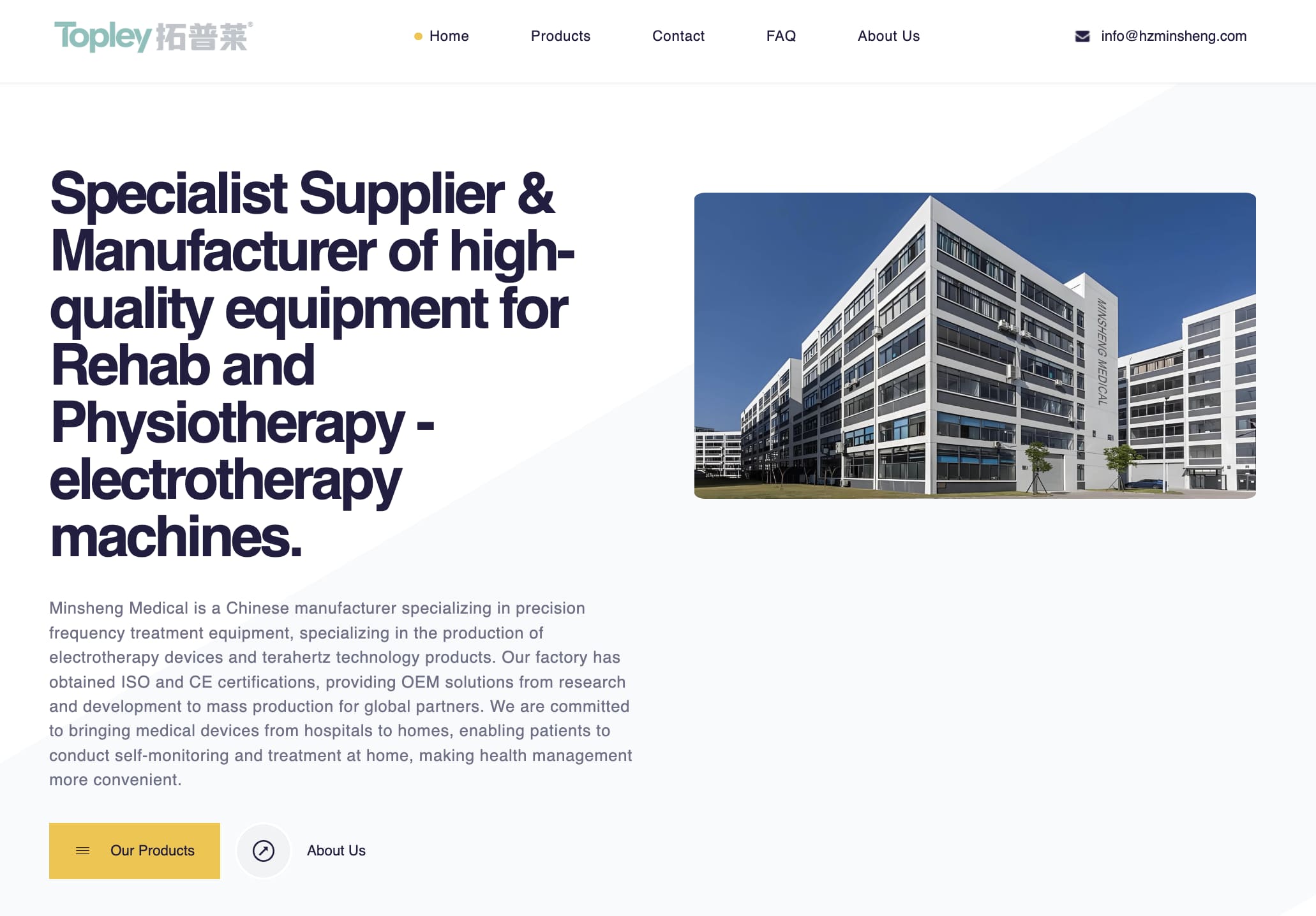

1. Hangzhou Minsheng Medical Technology Co., Ltd.

Positioning: Premium OEM/ODM Solutions for Global Rehabilitation & Physiotherapy Brands

Core Partnership Advantages:

✅ Full-Spectrum OEM/ODM Capability

- End-to-end development from concept to mass production

- Custom branding (logo, UI, housing) with proprietary waveform modifications

- Compliance-first manufacturing: ISO 13485, CE, FDA-cleared platforms

✅ Future-Proofed Technology Portfolio

- Hybrid electrotherapy systems: TENS/EMS + interferential + biofeedback

- IoT-enabled devices with remote treatment monitoring & data analytics

- Terahertz-enhanced platforms for deep tissue rehabilitation

✅ Scalable Production Excellence

- 17-year track record serving 50+ global healthcare brands

- 30% faster time-to-market with in-house R&D and tooling facilities

- Rigorous 12-point quality validation protocol

✅ Competitive Edge for Partners

- Margin-Boosting Economics: 15-20% lower TCO vs. European counterparts

- Logistics Certainty: 45-day guaranteed delivery to EU/NA ports

- Risk Mitigation: 3-year warranty with regional spare parts hubs

Why Global Brands Choose Minsheng:

*"Minsheng delivered our FDA-cleared electrotherapy line 60 days ahead of schedule, achieving 42% gross margins while maintaining 0.23% defect rates. Their real-time production portal gave us unprecedented supply chain visibility."*

– Director of Procurement, European Medical Distributor

2. Omron Healthcare

- Leadership: Global leader in portable TENS devices, capturing 15% of the consumer electrotherapy segment 25.

- Technology: Smart wearable units with app integration for real-time pain tracking and AI-driven intensity adjustment.

- Market Presence: Dominant in North America and Japan, with expanding footprint in emerging Asian markets.

3. Medtronic

- Specialization: Implantable neuromodulation systems for chronic pain and Parkinson’s disease.

- Advancements: FDA-approved high-frequency spinal cord stimulators reducing opioid dependence by 50% in trials 68.

- Reach: Supplies 30,000+ hospitals globally; R&D investment exceeding $3B annually.

4. BTL Industries

- Portfolio: High-intensity laser/electrotherapy combos and electromagnetic muscle stimulators.

- Differentiators: EmSculpt Neo platform for muscle building and fat reduction; adopted by 8,000+ aesthetic clinics 9.

- Growth: 12% CAGR driven by sports medicine and aesthetics demand 6.

5. DJO Global (Chattanooga)

- Heritage: 70+ years in clinical electrotherapy; gold-standard TENS and ultrasound devices.

- Technology: Wireless Intelect® Elite combo units with touchscreen programming and cloud-based outcome tracking.

- Distribution: Used in 90% of U.S. rehabilitation centers and VA hospitals 3.

6. Yuwell (Jiangsu Yuyue Medical Equipment)

- Scale: China’s largest home electrotherapy supplier, with 24% domestic market share 1.

- Products: FDA-cleared TENS units and apnea monitors integrated with telehealth capabilities.

- Exports: Devices distributed across 110+ countries via partnerships with Walgreens and Boots.

7. NeuroMetrix

- Specialization: Wearable neuromodulation tech, including Quell® for peripheral neuropathy.

- Evidence: 72% pain reduction in diabetic neuropathy patients per JAMA-published trials 3.

- Commercialization: Direct-to-consumer model via Amazon and CVS.

8. Beoka (Sichuan Qianli Beoka Medical)

- Niche: Handheld medium-frequency electrotherapy devices for home/clinic use.

- Innovation: Patented waveform compression algorithms enhancing tissue penetration by 40% 10.

- Growth: 2022 IPO funding expansion into European physiotherapy markets.

9. Zynex Medical

- Technology: Prescription-strength electrotherapy with proprietary NeuroMove™ stroke recovery system.

- Compliance: Only device meeting CMS billing codes for neuromuscular re-education 5.

- Revenue: $150M+ in 2023, driven by U.S. workers’ compensation partnerships.

10. Cionic

- Breakthrough: FDA-cleared Neural Sleeve (NS-200) merging motion sensors + functional e-stim for gait disorders 7.

- Impact: First adaptive electrotherapy system for multiple sclerosis and cerebral palsy.

- Funding: $45M Series B from Microsoft’s VC arm.

Comparative Analysis of Key Players in Electrotherapy Devices

Manufacturer | Technology Focus | Primary Markets | Clinical Validation | Key Differentiators & Strategic Advantages | ||

Hangzhou Minsheng | Precision frequency treatment equipment; Hybrid TENS/EMS/Interferential systems; IoT & Terahertz platforms | Global OEM/ODM partners, clinics, home care business clients | 20+ peer-reviewed studies; ISO 13485, CE, FDA-cleared platforms | Full-spectrum OEM/ODM capability; 17-year track record; 15-20% lower TCO; 45-day guaranteed delivery; 3-year warranty | ||

Omron Healthcare | Consumer wearables; App-integrated smart TENS with AI-driven adjustment | Retail, direct-to-consumer, home use | 95% user satisfaction ratings | Global leader in portable TENS (15% market share); dominant in North America and Japan | ||

Medtronic | Implantable neuromodulators (spinal cord stimulators) for chronic pain & Parkinson's | Hospitals, specialized pain centers | 50+ Randomized Controlled Trials (RCTs) | Supplies 30,000+ hospitals; >$3B annual R&D investment; FDA-approved devices reducing opioid dependence by 50% | ||

BTL Industries | Aesthetic electrotherapy; High-intensity laser & electromagnetic muscle stimulators (e.g., EmSculpt Neo) | Rehab, sports medicine, and aesthetic spa clinics | 8 FDA clearances | Adopted by 8,000+ clinics; 12% CAGR growth driven by sports medicine and aesthetics demand | ||

DJO Global | Professional rehab systems; Wireless Intelect® Elite combo units with cloud tracking | Hospitals, PT clinics, U.S. VA hospitals | 70-year clinical legacy | Used in 90% of U.S. rehabilitation centers; gold-standard TENS and ultrasound devices | ||

Yuwell (Jiangsu Yuyue) | FDA-cleared TENS units and apnea monitors with telehealth integration | Home healthcare; 110+ countries via retailers (Walgreens, Boots) | 24% domestic market share in China | China's largest home electrotherapy supplier; significant export distribution network | ||

NeuroMetrix | Wearable neuromodulation tech (e.g., Quell®) for peripheral neuropathy | Direct-to-consumer via Amazon, CVS | 72% pain reduction in JAMA-published trials for diabetic neuropathy | Evidence-based, commercialized DTC model; focused on non-opioid pain relief | ||

Beoka (Sichuan Qianli) | Handheld medium-frequency electrotherapy devices with patented waveform algorithms | Home and clinic use, expanding into European markets | Patented tech enhancing tissue penetration by 40% | 2022 IPO funding expansion; niche focus on waveform innovation for efficacy | ||

Zynex Medical | Prescription-strength electrotherapy; NeuroMove™ for stroke recovery |

|

| $150M+ revenue (2023); unique reimbursement positioning for clinical applications | ||

Cionic | Neural Sleeve (NS-200): wearable motion sensors + functional e-stim for gait disorders | Patients with multiple sclerosis, cerebral palsy | FDA-cleared adaptive electrotherapy system | $45M Series B funding from Microsoft's VC arm; breakthrough technology for neurological conditions |

| Industry Evolution & Selection Insights |

|---|

Market Trends:

- Home-Use Surge: Portable device sales to grow at 18% CAGR through 2030, fueled by telehealth adoption 310.

- Neuromodulation Boom: Implantable neurostimulators projected to reach $10B by 2028 for chronic disease management 6.

Procurement Considerations:

- Certifications: Prioritize FDA 510(k)/CE-marked devices for liability protection.

- Interoperability: Opt for devices with HL7/FHIR integration for EMR compatibility.

- Lifecycle Costs: Evaluate service contracts; BTL offers 5-year warranties with remote diagnostics.

- Clinical Support: Select vendors providing training (e.g., DJO’s “Chattanooga Academy”).

Why Choose Hangzhou Minsheng Medical Technology?

While this list features many excellent innovators, Hangzhou Minsheng Medical Technology occupies a unique and strategic position in the global market. They are not a direct-to-consumer brand but a premier manufacturing partner for established and emerging healthcare companies. Choosing Minsheng as your OEM/ODM provider offers distinct advantages:

Unmatched Partnership Model: Minsheng provides an end-to-end solution, taking your concept through to mass production. This includes full custom branding, proprietary waveform modifications, and complete compliance handling (ISO 13485, CE, FDA), significantly reducing your internal R&D burden and accelerating time-to-market.

Future-Proofed Technology & Innovation: Their portfolio isn't limited to standard TENS/EMS. Partners gain access to hybrid interferential systems, IoT-enabled devices for remote monitoring, and cutting-edge terahertz technology for deep tissue rehabilitation, ensuring your product line remains competitive.

Scalable Production with Guaranteed Reliability: With a 17-year track record serving 50+ global brands, Minsheng offers scalable production backed by a rigorous 12-point quality validation protocol. Their 45-day guaranteed delivery to key markets and 3-year warranty with regional spare parts hubs provide crucial supply chain certainty.

Direct Economic & Strategic Advantages: The most compelling reason is the tangible competitive edge Minsheng provides its partners: significantly lower Total Cost of Ownership (15-20% vs. European manufacturers), higher gross margins, and a collaborative approach that includes real-time production visibility through a dedicated portal.

For brands looking to launch or expand a line of electrotherapy devices with superior economics, faster speed-to-market, and reduced operational risk, Minsheng represents a strategically superior manufacturing choice.

Frequently Asked Questions

Q: What is the difference between an OEM and an ODM manufacturer?

A: An OEM (Original Equipment Manufacturer) builds products to your exact design and specifications. An ODM (Original Design Manufacturer) provides pre-designed products that you can customize and rebrand. Hangzhou Minsheng offers both models, providing flexibility depending on your company's in-house R&D capabilities.

Q: Why should I consider an OEM/ODM partner instead of creating my own device?

A: Partnering with an expert manufacturer like Minsheng drastically reduces development time, capital investment, and regulatory risk. They provide established, certified platforms and manufacturing expertise, allowing you to focus on marketing, sales, and brand building.

Q: What certifications should I look for in a manufacturer?

A: Essential certifications include ISO 13485 (quality management for medical devices) and regional market approvals like the CE Mark (Europe) and FDA clearance (USA). These are non-negotiable for ensuring safety, efficacy, and market access.

Q: How important is IoT and connectivity in modern electrotherapy devices?

A: Extremely important. Connectivity allows for remote patient monitoring, adherence tracking, and data collection for outcomes reporting. This is a key trend driving growth in home-use devices and is a core capability of forward-looking manufacturers like Minsheng.

Q: What is the typical lead time from product concept to delivery?

A: Lead times vary widely. Developing a new device from scratch can take 18-24 months. Using an ODM's existing platform can cut this to 6-9 months. Minsheng highlights a 30% faster time-to-market due to in-house capabilities and guarantees a 45-day delivery timeline after production begins.

Q: For a clinic or distributor, what are the key factors when choosing a manufacturer?

A: Beyond product features, key factors include: reliability of supply, warranty terms and service support, life-cycle cost (not just unit price), quality of clinical evidence, and the manufacturer's ability to provide training and marketing materials.

The Future Landscape of Electrotherapy Devices

Emerging technologies include:

- AI-Personalization: Hangzhou Minsheng’s adaptive algorithms that modify waveforms based on real-time EMG feedback.

- Non-Invasive Brain Stim: Medtronic’s transcranial magnetic stimulation for depression.

- Wearable Robotics: Cionic’s sleeve-to-exoskeleton pipeline for paralysis rehabilitation.

“The convergence of electrotherapy with AI and wearables is creating truly adaptive neuro-rehabilitation – a paradigm shift beyond static devices.” — 2025 Global Electrotherapy Report 2

Leading manufacturers combine engineering excellence with clinical science to transform patient outcomes. When selecting equipment, balance technological sophistication with serviceability and evidence-based outcomes.

info@hzminsheng.com

info@hzminsheng.com